Empty Rivers of Promise

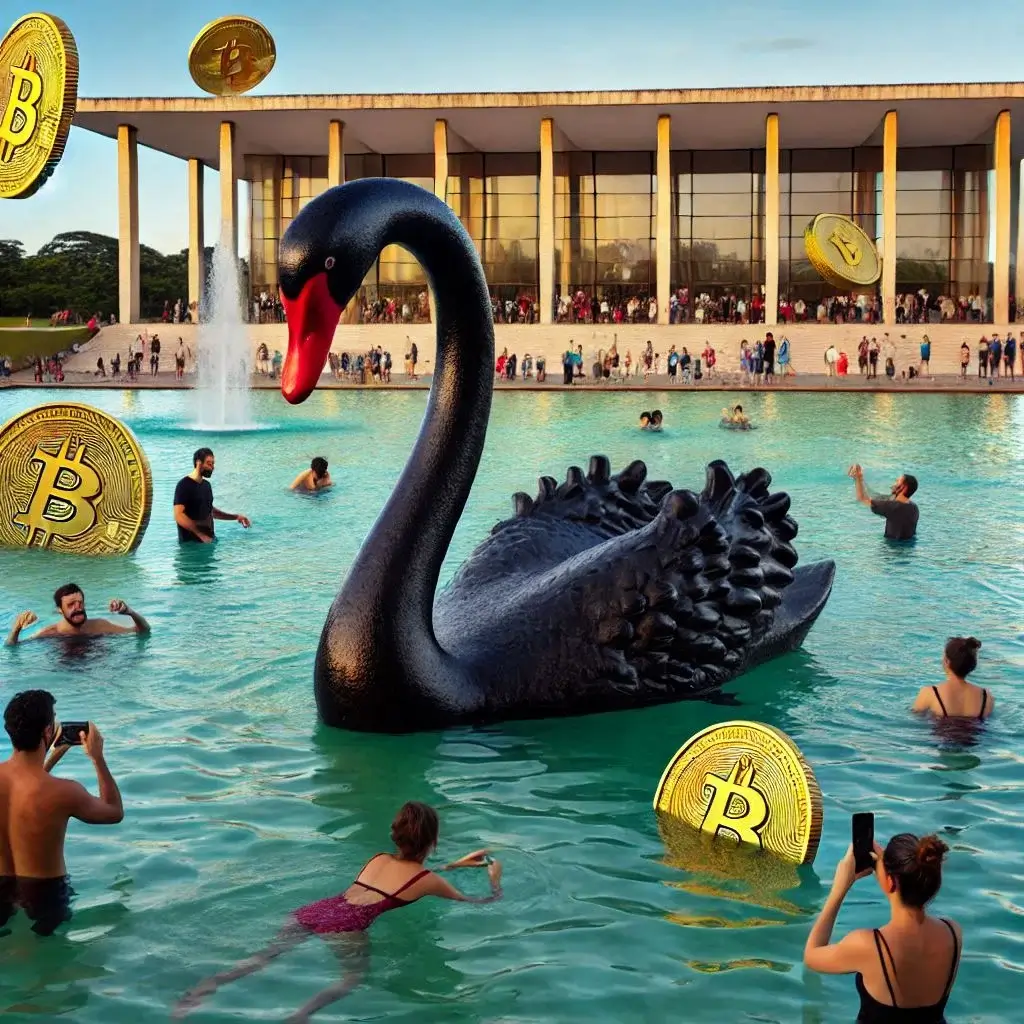

Latin American, Caribbean Corruption and Hope eyesonsuriname Amsterdam April 1st 2025–In the shadow of lush rainforests and along the banks of murky rivers, another kind of darkness lurks – one created not by nature, but by human hands. Corruption, like a slow-flowing undercurrent, has embedded itself in the foundation of Suriname and its Caribbean sister islands, where…

Read more

Recent Comments