Is The Monetary and Financial Crisis Caused by Capitalism??

Or not ?

eyesonsuriname/philipcross

Amsterdam, Feb 7 2023–Faith in capitalism waned somewhat during the global financial crisis of 2008-2009 and has been slow to recover, with a growing number of young people professing support for socialism.

But what today is called socialism is just a poorly functioning version of capitalism, where government regulations, spending and redistributive taxation throw ever more truckloads of sand into the free market’s gears.

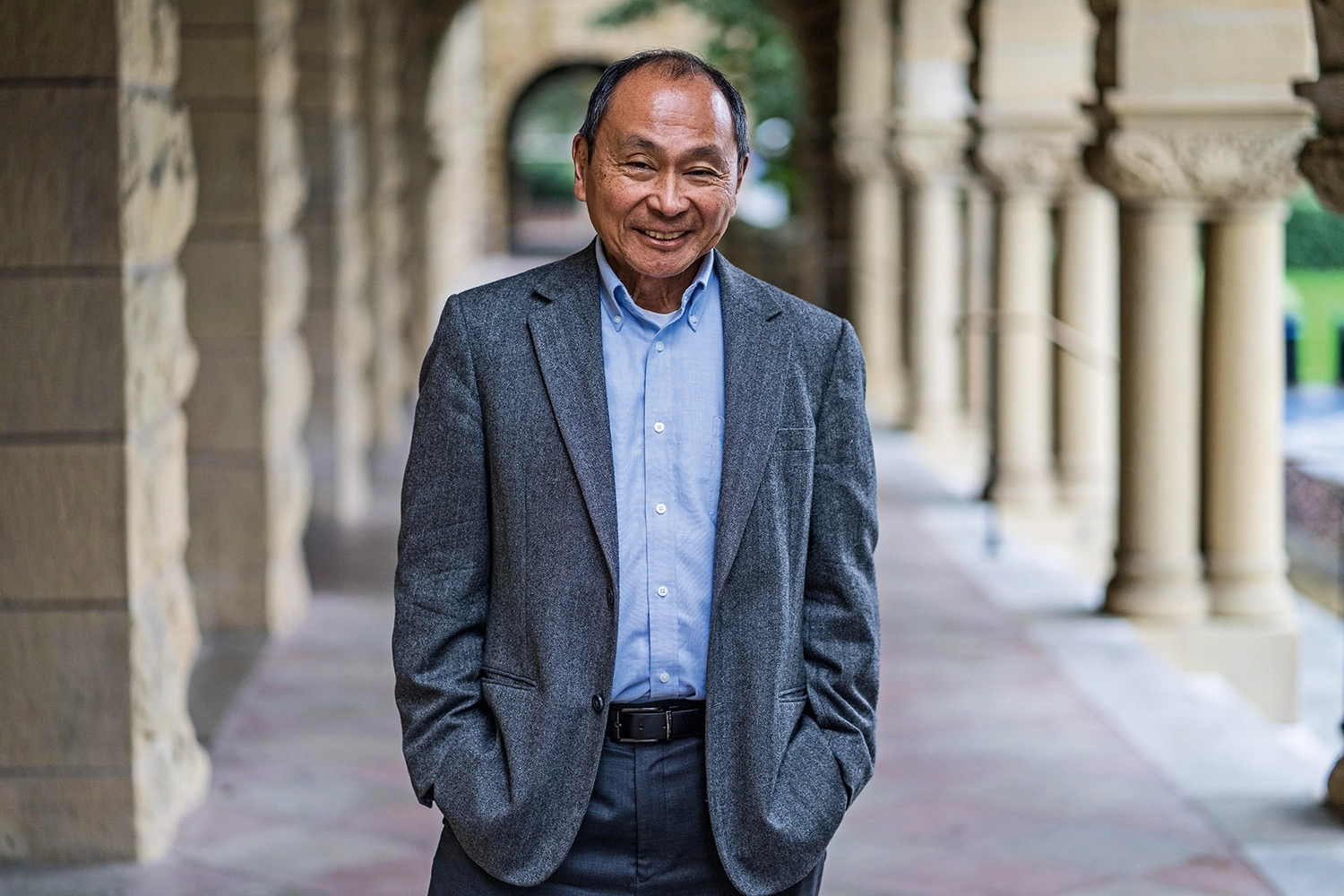

Francis Fukuyama was right to declare in his 1992 book, The End of History and the Last Man, that capitalism had triumphed — if at least partly because, strictly-speaking, there is simply no realistic alternative.

But it’s a hollow victory when governments don’t allow capitalism to function properly and economic growth continues to sputter along at rock-bottom rates like those socialism produced.

But then the western world’s post-war economic boom, followed by the economic transformation of Southeast Asia, demonstrated convincingly that capitalist, market-based economies could deliver sustained rapid economic growth.

Furthermore, most people found that working for business brought, not alienation, but a sense of purpose. As a result, criticism of capitalism as inefficient and unable to generate satisfactory growth faded.

After the fall of the Iron Curtain and the development of capitalism in China (even if political scientist Yuen Yuen Ang is probably correct that China is best understood as a capitalist dictatorship), no country besides North Korea has seriously pursued government control of the means of production.

Instead, today’s critics, such as Thomas Piketty, fault capitalism for producing excessive and not strictly necessary inequality.

Their complaint appears to resonate with the public. In a 2019 article on millennial socialism, The Economist magazine cited a Gallup poll in which Democratic voters in the U.S. indicated they preferred socialism to capitalism by more than 10 percentage points.

A 2021 article in this newspaper by Kristian Niemietz of London’s Institute of Economic Affairs argued that “the overwhelming majority of young people really do express stridently anti-capitalist views,” while associating socialism with fuzzy feel-good concepts such as “workers,” “equal,” “public,” and “fair.”

The result, according to Washington Post columnist George Will, is that “today’s watery conceptions of socialism amount to this: Almost everyone will be nice to everyone, using money taken from a few. This means having government distribute, according to its conceptions of equity, the wealth produced by capitalism.”

Focusing on redistributing capitalism’s riches ignores how government interference hinders the drivers of long-term economic growth.

This ignorance is partly the fault of economists. In his 2014 book, The Free-Market Innovation Machine, famed theorist of economic growth William Baumol wrote that the “virtual absence of any explicit attempt to explain the fabulous growth record of the free-enterprise economies in general, with their transformation of living standards and creation of technological innovations undreamed of in any previous era, is perhaps the most glaring omission of recent economic growth theory, despite all of its substantial contributions.”

By not sufficiently emphasizing the unprecedented improvement in living standards, economists left capitalism open to unfair and unfounded criticism.

The economic historian Deirdre McCloskey proposes one solution would be to change the system’s name from the Marx-rooted “capitalism” to Schumpeterian-inspired “innovationism,” which would underscore how incubating and developing new ideas is the essence of decentralized, market-based economies.

The problem with the modern version of socialism, which asks capitalism to lay the golden eggs for governments to collect and distribute, is that it leads to inefficiency and chronically slow growth. This returns full circle to the early 20th-century critique of capitalism for underperformance. High levels of taxation and regulation increasingly weigh down economic growth and discourage innovation in Canada, Europe and Japan.

The longer we remain in a low-growth equilibrium, the more we end up focusing on zero-sum redistribution of a shrinking economic pie rather than greater investment and more rapid economic growth. Growth is still possible, however, despite an aging society: the United States has maintained the highest levels of economic growth and innovation in the western world largely because it has best resisted slow suffocation of the entrepreneurship, competition and innovation that are the well-spring of capitalism.

PhilipCross/eyesonsuriname