Suriname: challenge to create a new, modern economy.

The first steps.

by Anthony Caram

Amsterdam, February 21st 2022– Deep changes are needed, because we are confronted with obstacles and bottlenecks in every area. Therefore, the emphasis should gradually be placed on sustainable production and export growth, controlled consumption at more realistic prices, as well as more balanced budgetary and monetary relations.

Prosperity growth and development. However, an essential pre-condition for being able to carry out the many plans is that our capacity to implement projects is materially expanded. After all, actual development is limited by the most pressing bottleneck: our implementation capacity. Increasing it requires multifarious, intensive efforts.

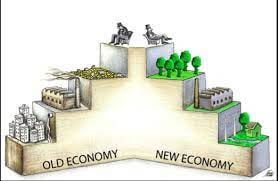

1. From the old to a new economy

We are facing really big challenges to transform the old economy of Suriname. This transformation is necessary. The economy is caught in a complicated combination of mutually reinforcing factors that hinder its development.

It is well known that the old economy is characterized by an excessive emphasis on consumption in relation to domestic production, an excess of imports of goods and services, insufficient productive investment, a lack of dynamic and innovative private sector, an excessively large state apparatus and an excessive system of government subsidies that distort the market and have a wasteful effect. This causes the postponement of necessary infrastructural investments and extensive budget deficits, financed by money creation and debt expansion.

The factors indicated have contributed to the derailment and stalling of the old economy. This is reflected in, among other things, balance of payments deficits, deterioration of the internal and external value of our money and unbearable debt repayment obligations borne by the state.

We face the challenge of creating a new, modern economy. The first steps in this direction are already being taken. Deep changes are needed, because we are confronted with obstacles and bottlenecks in every area. Therefore, the emphasis should gradually be placed on sustainable production and export growth, controlled consumption at more realistic prices, as well as more balanced budgetary and monetary relations.

It is necessary to create an environmental climate and a dynamic development mindset in both the public and private sectors, which stimulate and lead to real economic activities. Implementing such a transformation, experience has shown, is a major challenge for any country, as well as a tedious and lengthy process. This challenge carries extra weight in Suriname. Especially the small scale of the economy and its specific, weak characteristics associated with it act as a brake.

2. Transforming initially requires strenuous efforts and causes pain

IT IS AN illusion to assume that our efforts to get the transformation process on track will bear fruit in a short time in accordance with our wishes and expectations. It is clear that much work has already been done, but it is also clear that much more remains to be done.

An annoying characteristic of a transformation process is that, despite all the efforts and sacrifices of land and people, it will first get worse before it can get better. This entails the obligation to offer substantial support to the socially disadvantaged already in the first stage of this process. On the other hand, the Minister of Finance and Planning does not yet have the budgetary scope to meet this obligation. That is why strengthening mutual solidarity, including our immigrant community, is equally necessary.

The initial deterioration of the economic situation is also painfully reflected in Suriname in the acceleration of the inflation rate and the corresponding reduction in the purchasing power of citizens since 2020. The acceleration can be explained by the fact that the transformation process is accompanied by higher prices. , which result to a large extent from the increase of the official exchange rate of foreign currencies to the level of the quotations on the cambio market and from the restructuring and austerity of the subsidy system.

Policy measures are considered inevitable to reduce consumer overspending, make the fiscal position sustainable and improve the monetary and financial situation. An additional complication is that for more than two years now we have been confronted with the effects of the corona crisis and with the recent acceleration in imported inflation, which are further hurting domestic activity and giving additional impetus to price increases.

It is understandable that the decline in the purchasing power of their income and wealth means that citizens are currently going through difficult times, feeling disappointed and gloomy. To temper this disappointment, it is desirable to accelerate the further expansion of the social safety net, insofar as this is budgetary and monetary justifiable.

Communication with the population should also be intensified in order to better explain to them what the objectives of the policy are and what can be expected from it in the future. In this context, more quantitative insight is needed into the underlying causes of inflation. The published statistics should show the individual price effect of government measures taken, the increase in factor costs and imported inflation. In other words, it is important to measure to what extent inflation is caused by supply or demand factors, given the flow of money circulating in the national economy.

It must also be determined whether the price effect is incidental or permanent in nature. In the first case, the effect runs out of the price index of household consumption after one year. A policy measure will then no longer contribute to a further rise in domestic inflation. Partly due to the intended run-out, average monthly inflation fell from 3.9 percent during the fourth quarter of 2020 to 2 percent in the corresponding period of 2021.

The pace of annual inflation is decreasing from 61 percent in 2021 to an expected 38 percent in 2022. The latest figure is a projection from the International Monetary Fund (IMF), which also predicts that the downward trend will continue gradually and by 2025 the level of 7.9 percent.

Account has been taken of the possible effect of additional policy measures, including the introduction of the value added tax and the possible increase in electricity tariffs. The figures indicate that although there is an improvement from the peak reached in 2021, we cannot be satisfied with this.

The Central Bank of Suriname (CBvS) is committed to moderating the inflation rate. It has been assigned by law a pioneering role as guardian of the stability in the internal and external value of our money, insofar as this stability is dependent on monetary factors. However, its role has been periodically undermined by populist-minded fiscal and monetary policies, as well as institutional weakness. I am therefore pleased that an excellent draft of a new Banking Act is now available, which should above all strengthen its internal organizational structure and autonomy.

I do have difficulty with the provision that the state may again call on credit facilities from the CBvS after 2024, albeit under strict conditions. I strongly argue in favor of removing this provision from the draft. This in view of the painful experiences with this lending, which were the result of a lack of discipline and a misinterpretation of the letter and spirit of the law still in force.

Another more technically grounded comment on my part relates to the deposit auction system recently introduced by the CBvS. I wonder whether the time has come to base interest rates almost exclusively on the functioning of a financial market that has not yet matured.

Partly due to market imperfections, the system contains the risk that the interest costs will be higher than the yields; the latter in the sense of its contribution to promoting the internal and external stability of our money. There is also doubt about the effectiveness of the transmission mechanism.

In this regard, I note that the recent decline in the rate of growth in monthly inflation does not appear to be primarily the result of deposit auctions, but rather of the effect of previously implemented policy measures drifting out of the price index. An important factor here is that a considerable part of society’s excess liquidity has already been absorbed by inflation. In addition, bank lending is growing only moderately, partly due to the slack in general activity and the prevailing uncertain environmental climate.

Although parts of the system have already been adapted, based on the experience gained, further adjustments can be considered if possible. In my opinion, adjustments can best be achieved through further intensification of consultations with the IMF and the other banks. Given the limited number of banks, moral suasion seems to be a useful alternative to optimize the effectiveness of the monetary instruments and minimize the costs of the auctions.Although parts of the system have already been adapted, based on the experience gained, further adjustments can be considered if possible. In my opinion, adjustments can best be achieved through further intensification of consultations with the IMF and the other banks. Given the limited number of banks, moral suasion seems to be a useful alternative to optimize the effectiveness of the monetary instruments and minimize the costs of the auctions.

3. Sacrifice and effort now create a sustainable basis for development

I am surprised by reports that a depressed mood is currently predominant in Suriname. Despite the difficult time we are currently going through, we can have confidence in the long-term development potential of our economy. There are opportunities to reduce existing poverty and increase our prosperity.

The contraction in gross domestic product is expected to be reversed as early as 2022. This product is estimated to increase by a total of approximately 20 percent in 2020 and 2021. According to an IMF projection, growth will be around 2 percent in 2022.

Incidentally, these figures indicate that we still have to regain much of the ground that has been lost.

We all have our own specific responsibility to regain this loss of ground and subsequently achieve further growth. To achieve this goal, we will have to work more intensively to reduce the effects of the bottlenecks that hold the old economy in their grip. It is encouraging that we now have a compass to support us on the arduous journey into the future.

The 2020-2022 Recovery Plan and the IMF Loan Document contain a range of recommendations and projects, primarily aimed at restoring more balanced fiscal, monetary and financial relations. In addition, the Multi-Year Development Plan provides an innovative vision for a sustainable, climate-friendly increase in production and exports through the creation of sectoral clusters. This plan also includes an agenda for achieving the United Nations’ Sustainable Development Goals.

The plans provide sufficient handles and direction to initiate a more balanced economic development through the transformation process. Success is achievable to the extent that, through wise policies and good executive management, we succeed in expanding the exploitation of our natural resources and growing associated clusters.

I am convinced that a responsible intensification of this exploitation offers us more opportunities to enforce prosperity growth and development. However, an essential pre-condition for being able to carry out the many plans is that our capacity to implement projects is materially expanded. After all, actual development is limited by the most pressing bottleneck: our implementation capacity. Increasing it requires multifarious, intensive efforts.

Time is running out. We need to prepare in a planned and purposeful way in order to participate in and take full advantage of, in particular, the expected boost that the oil and gas cluster will give to our development opportunities over the coming period, despite the changes taking place in the global energy market. The extra income to be obtained from this cluster should also be used to promote the much-desired sectoral diversification of production and exports, to cover the basic needs of the population and to make deposits into a savings fund to absorb setbacks.

We must not be discouraged by the setbacks and disappointments that we will inevitably face now and in the future. Let us work in unison, enthusiastically, persistently and tirelessly to achieve the goals set. Keeping in mind that transforming an economy is never an easy road.

Antony Caram