Suriname signs Letter of Intent

For a safer, more reliable country

eyesonsuriname

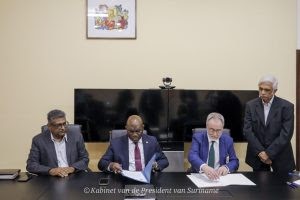

Amsterdam, March 9, 2023– Suriname has signed a letter of intent with the American research and risk consultancy firm, Kroll Risk and Financial Advisory Solutions.

The country is represented by the ministers of Justice and Police and Finance and Planning.

The agency will assist Suriname in closing gaps so that the country can eventually meet the conditions set by the Financial Action Tast Force (FATF) not to be blacklisted when it comes to tackling money laundering, terrorist financing and proliferation financing of illegal trade in arms and ammunition.

The MoU was signed on Thursday, January 26, 2023 in the presence of President ChanSantokhi.

The evaluation of Suriname’s Mutual Evaluation Report (MER) by the Caribbean Financial Action Task Force (CFATF) showed that the country still has a lot of work to do to prevent blacklisting.

Based on this, the Anti-Money Laundering Steering Council has asked to revise the first National Anti-Money Laundering Strategic Plan, which according to Mr. Roy Baidjnath Panday coordinator of the Project Implementation Unit (PIU) of the Anti-Money Laundering Program 12 focus areas has delivered. From all the activities that arise from these 12 focus areas, there are 150 action points that can be further elaborated in sub-action points.

The PIU coordinator says that this total collection of action points has taught us that the Surinamese technical capacity – which the country has at its disposal and which already plays a role in the whole – is by no means sufficient to correctly address all themes.

Ultimately, the Ministers of Justice and Police and Finance and Planning were asked to identify technical experts with an international reputation. It had to concern experts who have assisted other countries and with whom Suriname can gain experience in order to take the necessary improvement steps in a shortened period to eliminate the backlog in tackling terrorism and illegal arms financing and money laundering, as well as to establish introducing legislation to this end.

In the process that started more than a year ago, Suriname ended up with the American agency. “It is an entity that operates in more than 30 countries worldwide with its headquarters in New York. The agency has offices in European countries including the Netherlands and England, but also Asia, the Middle East and South America,” says Mr. Baidjnath Panday. He indicates that Kroll also has partnerships with international organizations such as the International Monetary Fund (IMF) and is familiar with standards of the Inter-American Development Bank (IDB).

“Their familiarity with this international network has prompted the government to discuss working with Kroll.” According to the PIU coordinator, the ministers of Justice and Police, and Finance and Planning have taken the initiative to invite Kroll at the highest level in which the agency operates to visit Suriname.

The three-member delegation started a four-day program on Monday, January 23, in which they spoke to policymakers, in particular the aforementioned ministers, the Governor of the Central Bank of Suriname, the acting Attorney General and the Minister of Natural Resources (NH). . Subsequently, the team entered into discussions at a technical level with managers of the Suriname Police Force (KPS), because of the involvement of the financial investigation team within the force; the Disclosure Center for Unusual Transactions (MOT); the Gaming Board; the Foreign Exchange Commission; the National Anti-Money Laundering Committee and the Anti-Money Laundering PIU.

Over the past period, a good picture has been presented to the expert team, which in turn has communicated its conclusions to government officials. Subsequently, a declaration of intent was drawn up on what had been established mutually and with the consent of both parties over the past two days.

The PIU coordinator says that the MoU expresses the intention that the government of Suriname has confidence in identifying Kroll as an internationally operating partner with expertise in FATF matters. The bureau develops international standards through recommendations.

Suriname currently has 40 international recommendations to make its financial system more robust in terms of enforcement and supervision. According to Baidjnath Panday, it is important that international financial institutions as well as the international investment community mainly pay attention to the financial and economic position of the country in order to invest there.

He emphasizes that financial institutions in Suriname must operate within healthy frameworks, especially with their foreign corresponding relations so that they do not end up in a danger zone. The main aim is to prevent the country from being judged in the next reporting period – in November this year – as a country that is not cooperative in closing the gaps that have been identified.

To prevent this from happening, the government has committed itself to take the necessary steps at national level through the declaration of intent with the assistance of a team of experts.

It is also about Suriname trying to comply with the 40 recommendations of the FATF within the timeline set by this international organization. Within this process, all stakeholders in the public domain have already been very emphatically sought out to make their contribution. Within the whole, ministers with direct responsibility will be the initiators and the private sector will also be consulted for its contribution.

eyesonsuriname